Apple Pay has become an incredibly popular and convenient way for iPhone users to make purchases and payments. With just a tap or glance at their iPhone or Apple Watch, users can quickly checkout at stores, pay within apps, and send money to friends.

But one common question many new Apple Pay users have is “Does Apple Pay show up on my bank statement?” Below we’ll cover the details users need to know regarding how Apple Pay appears on bank statements.

Does Apple Pay show on your bank statement?

The short answer is yes, Apple Pay purchases and transactions do show up on your regular bank statements.

When you use your debit card or credit card via Apple Pay, you are still using that underlying physical card – Apple Pay is just providing a secure, digital way to pay with that card. So all your Apple Pay transactions will show up normally on your bank statements, similarly as if you had physically swiped or inserted your card.

The Apple Pay transactions will display the merchant name where you made the purchase. Your bank statement won’t specifically say “Apple Pay”, but will show the merchant name as usual.

The transactions will look the same as any other standard card purchases on your statement. Apple Pay itself does not show up – only the normal transaction info from your underlying credit/debit card.

Apple Pay statement details

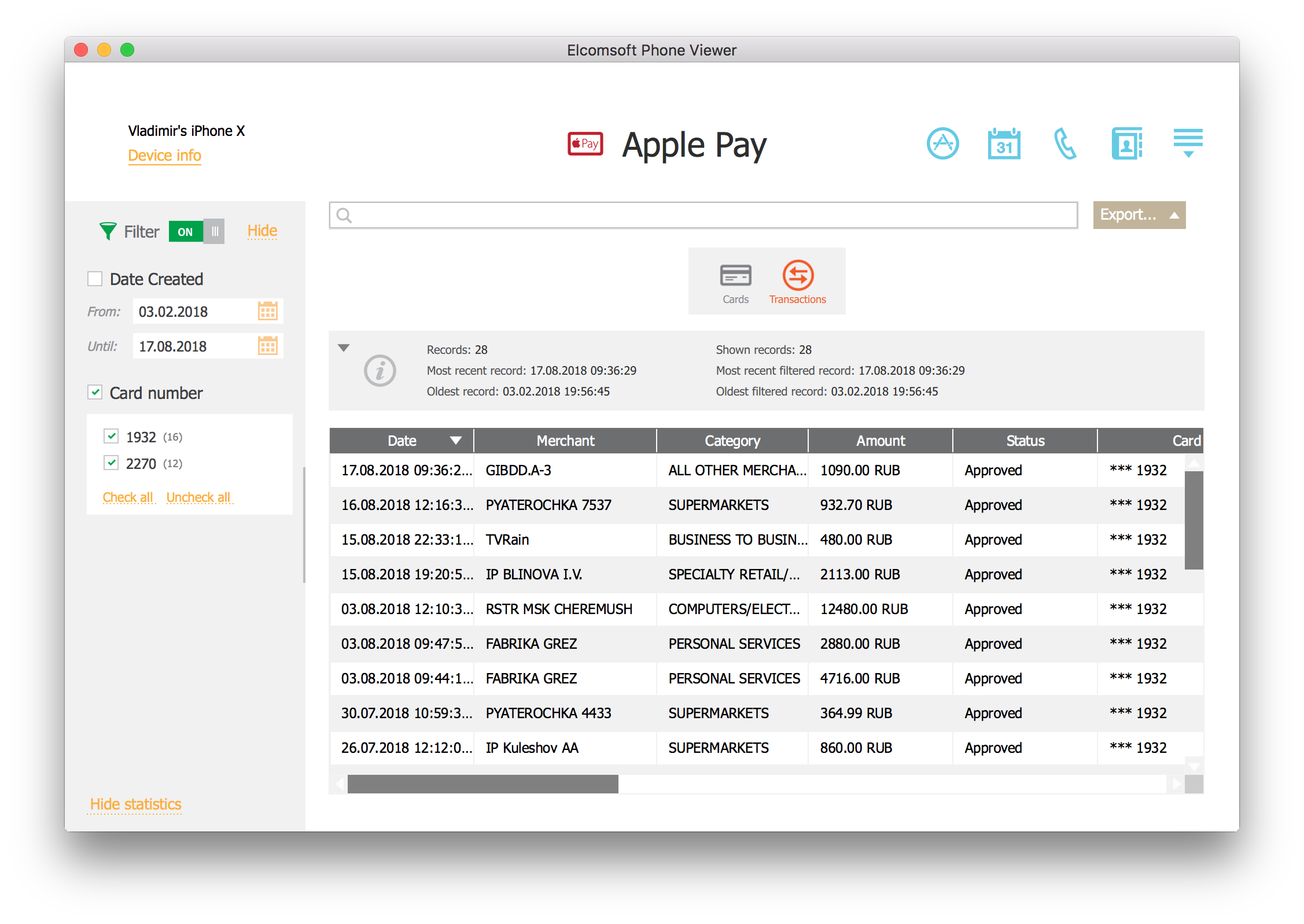

Here are some of the key details that will display for Apple Pay transactions on your regular bank statements:

- Merchant/Seller name: The statement will show the name of the merchant, retailer, app, website, etc. where you used Apple Pay to make the transaction. For example, it may say “Target” or “Starbucks” or “Uber”.

- Transaction amount: The bank statement will clearly display the amount you paid using Apple Pay, just like any other transaction amount.

- Date: The date the transaction was made will be shown.

- Location: If available, the city and state where the transaction occurred may be displayed.

- Category (optional): Some bank statements may also categorize the Apple Pay transaction into groups like “Food & Dining”, “Entertainment”, “Travel”, etc. if the data is available.

- Credit/Debit: The statement will make clear whether the transaction was done from a credit or debit card linked to Apple Pay.

So in summary, your regular banking statements will display all the typical transaction details, without specifically mentioning Apple Pay. Your monthly statement won’t differentiate an Apple Pay payment vs. a standard card swipe payment – they will all get grouped together based on your underlying credit/debit card used.

Why Apple Pay doesn’t show up directly

Apple Pay itself doesn’t directly display on your statement for a couple reasons:

- Apple Pay uses your existing cards: When you link a credit or debit card to Apple Pay, it doesn’t become a completely separate payment method – you are still using that underlying physical card, while Apple Pay provides the convenience of contactless digital payments. So since it’s still your existing card making the purchase, only the card will display.

- Added security: Not displaying “Apple Pay” directly also provides an extra level of security and privacy, since your bank statement won’t reveal everywhere you use mobile wallet payments. This avoids potentially exposing that you frequently use Apple Pay to random parties who may see your statement.

- Apple Pay is just a conduit: Apple Pay itself is just a conduit allowing you to digitally access and use your existing cards. All the payment mechanics and transaction info is still handled by your bank/card issuer – Apple simply provides the technology layers for easy mobile payments. So only your standard card details appear.

So in summary, Apple Pay is just providing a convenient way for you to use the cards you’ve already got. Your bank statements will continue to reflect your typical card transactions and charges as usual.

Check your card statements for Apple Pay payments

Because Apple Pay purchases will show up like any normal card transaction, you can check your monthly card statements if you ever need to:

- Review Apple Pay payment history.

- Check for unauthorized Apple Pay transactions.

- Look up a specific Apple Pay purchase amount or merchant.

- See recurring Apple Pay subscriptions and charges.

- Compare bank statement to your Apple Pay payment receipts in Wallet app.

- Check that a refund was processed for an Apple Pay return/exchange.

The transaction data from your credit card or bank account linked to Apple Pay will provide all the Apple Pay payment details you need. Just look for those normal purchases from merchants where you last recall using Apple Pay.

If you use your physical credit/debit card only rarely now, any new charges appearing are likely from Apple Pay if the merchant names match your memory. review your statements regularly just as you would with your physical cards.

Special case: Apple Card statements

The one exception is the Apple Card, Apple’s own credit card issued in partnership with Goldman Sachs. Since Apple issues the Apple Card statements directly, Apple Pay transactions on an Apple Card will explicitly say “Apple Pay” on the statement:

- Purchases made by tapping iPhone or Apple Watch at stores will display as “Apple Pay” transactions on the Apple Card statement.

- Within the Wallet app, Apple Card statements clearly mark Apple Pay payments vs. physical Apple Card swipes.

So if you use Apple Card with Apple Pay, the “Apple Pay” branding will prominently display on your transactions. This provides an extra level of clarity since Apple issues the card and also manages Apple Pay.

Manage Apple Pay through your bank or card app

In most cases, the best place to manage your Apple Pay transactions and details is:

- Your bank’s website or mobile banking app

- Your credit/debit card issuer’s online account portal or mobile app

These tools allow you to:

- Quickly view Apple Pay transaction history.

- Check pending Apple Pay payments that haven’t yet cleared.

- Report unauthorized Apple Pay purchases or charges.

- Monitor Apple Pay billing statements for subscriptions.

- Initiate refunds or disputes for Apple Pay transactions.

- Temporarily freeze or permanently remove a card from Apple Pay.

- Adjust notification settings for Apple Pay purchases.

Since your bank and card issuer have all the underlying transaction info that powers Apple Pay, their mobile apps or account tools provide the most direct way to manage Apple Pay payments. Check your monthly paper or digital card statements for Apple Pay purchase history as well.

The Wallet app also provides access to basic Apple Pay payment information and merchant receipts for your reference. But for detailed transaction history, statuses, refunds, disputes, etc. go directly through your bank’s channels.

Apple Pay provides payment privacy

One of the great features of Apple Pay is that it allows you to keep your payment details private in certain situations:

- Contactless payments: Tapping your iPhone or Apple Watch at terminals means you don’t have to hand your physical card to cashiers or waiters, protecting your card number.

- Private digital receipts: Apple Pay receipts in the Wallet app only show the last 4 digits of your card number, the merchant name, date, and amount.

- Exact card numbers hidden: Your bank statements show merchant names from Apple Pay transactions, but not the full card number you used.

- Unique Device Account Numbers: Your actual credit/debit card numbers are never shared with merchants. Apple Pay uses one-time dynamic security codes and unique Device Account Numbers to process transactions.

So Apple Pay provides more privacy than your physical cards in many cases. Your full card details are rarely exposed or displayed, and merchants don’t see your name, card number, or security codes in most Apple Pay transactions at checkout. contactless mobile payments help keep your financial account details more private.

Is Apple Pay worth using?

In general, Apple Pay is very worthwhile for iPhone owners for a number of great reasons:

- Convenient: It’s much faster and more convenient than pulling out your physical wallet and card when it’s time to pay. Just tap or glance at your iPhone or Apple Watch.

- Secure: Apple Pay transactions require biometric authentication via Face ID or Touch ID to use your cards. Your card details are never shared directly with merchants.

- Private: Apple Pay keeps your name, card number, and security code private in most transactions, while still providing receipts in your Wallet app.

- Accepted widely: Apple Pay is accepted at millions of retail stores, apps, and websites for in-store, in-app, and online payments. Support is nearly universal wherever contactless payments or digital wallets are accepted.

- Works internationally: Apple Pay can be used when traveling internationally just as easily as domestically for global payments coverage.

- Rewards & perks: You still get all the same points, miles, cash back, and other credit card rewards you would by using your physical card. Apple Pay does not affect your benefits.

- No fees: There are typically no extra charges, fees, or penalties from your bank for using Apple Pay vs. your physical credit and debit cards. Purchases look the same on statements.

Just be sure to periodically reconcile your Apple Pay charges to your monthly card statements and bank accounts to make sure everything looks accurate, as you should with any payment method. But overall, Apple Pay delivers a much more seamless payment experience vs. cards.

Conclusion

While Apple Pay doesn’t display directly on bank statements, rest assured all Apple Pay transactions appear on your regular monthly statements just like normal purchases you make with your physical credit and debit cards.

Apple Pay charges will show the merchant names and transaction details as usual. So monitor your card and bank statements periodically to check your Apple Pay payment history, watch for unauthorized transactions, ensure refunds were processed, and more.

With Apple Pay providing a convenient, private, and secure way for iPhone owners to make purchases and payments, it is well worth using as a primary payment method while still providing all the transaction information you need right on your regular monthly statements.

FAQs

Here are answers to some frequently asked questions about Apple Pay and bank statements:

-

Does Apple Pay show up separately on my statement?

No, Apple Pay purchases will not display separately from other card transactions on your statement. They will be mixed together with your other purchases under the same credit/debit card account. -

What merchant names will display for Apple Pay?

The merchant name on your statement will be the actual physical store, app, website, etc. where you used Apple Pay to make the purchase. Your statement won’t say “Apple Pay.” -

Can I tell which transactions were Apple Pay vs card swipes?

There is no way to definitively distinguish Apple Pay transactions from regular card swipes just by reviewing your monthly statement. They will be grouped together. -

Do I need to monitor Apple Pay transactions separately?

No other special monitoring is needed. Check your statements normally as you would to review all your credit/debit card transactions regardless of payment method. -

Where do I report unauthorized Apple Pay charges?

Contact your card issuer or bank provider immediately to report any unknown Apple Pay charges the same as any unauthorized card transaction. They can dispute charges and issue refunds. -

Does Apple see my Apple Pay transactions?

No, only your bank/card provider processes the actual transaction details. Apple does not directly receive or store details on your Apple Pay purchases. -

Are Apple Pay refunds processed separately?

No, Apple Pay returns and refunds will display on your statement the same as usual card refund transactions. There is no difference in how they display. -

Can I get receipts for my Apple Pay transactions?

Yes, the Wallet app saves receipts for all your Apple Pay transactions so you can view merchant names, amounts, locations, and partial card numbers used. -

Do I need to activate something to see Apple Pay on my statement?

No activation is needed. As long as your bank or card provider supports Apple Pay, transactions will appear on your monthly statements automatically. -

Can I use Apple Pay without the charges appearing on my statement?

No, all Apple Pay transactions must connect to an underlying debit or credit card account and will thus display normally on your associated monthly statements. -

Do Apple Pay transactions affect my credit score or utilization?

Apple Pay has no direct effect on your credit. But any purchases you make via Apple Pay will count towards your overall card utilization and impact your credit score like normal transactions. -

Are Apple Pay transactions grouped separately on my statement?

No, Apple Pay transactions will be mixed in chronologically with all your other standard card charges. There is no separate section for Apple Pay purchases. -

I only see partial card numbers on receipts. Where do I see full card details for Apple Pay?

You will need to look at your actual monthly card statement from your bank or card issuer to see the full card number that was charged for any particular Apple Pay transaction. -

Can I see a full history of locations I’ve used Apple Pay?

Your bank statement will show merchant names and locations for all your Apple Pay transactions. The Wallet app provides individual payment receipts but not a full purchase history report. -

Do I need to report Apple Pay use on my taxes?

No, you do not need to separately report or itemize Apple Pay transactions. All your payment method types get grouped together in your tax documentation from your bank. -

Is it risky to let Apple Pay transactions show on my statement?

No, Apple Pay is very secure. Letting charges appear on your statement carries no more inherent risk than standard card use. As always just monitor your statement routinely for unauthorized activity. -

Do recurring Apple Pay charges like subscriptions display differently?

No, recurring Apple Pay transactions from subscriptions, memberships, etc. will appear on your statement the same as any other recurring charge – there will be no Apple Pay distinction. -

Can I use Apple Pay without my transactions appearing on a statement?

Unfortunately no, Apple Pay must always be connected to a real debit or credit card, so transactions will necessarily show up on your associated card statement as a result. -

Who do I contact if my Apple Pay charges are incorrect or fraudulent?

Contact your underlying credit card provider or bank associated with the incorrect Apple Pay charge. They can dispute transactions, issue credits, investigate fraud claims, and take other actions just like normal card disputes.