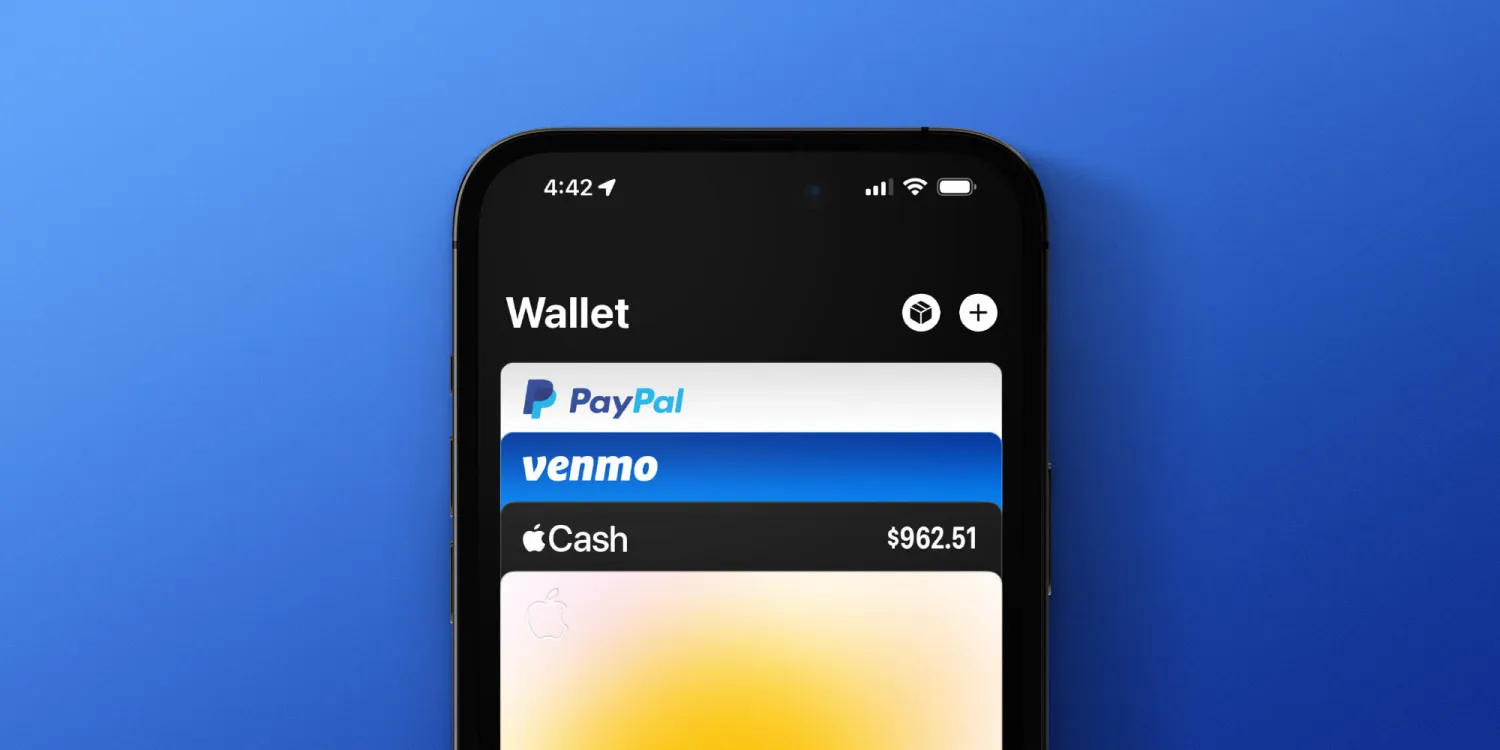

Apple Wallet and PayPal are two of the most widely used digital wallet platforms. Both allow you to store payment information and pay for goods and services online and in stores. However, there are some key differences between Apple Wallet and PayPal in terms of compatibility, payment options, security, and integration.

Overview of Apple Wallet

Apple Wallet, previously known as Passbook, is Apple’s digital wallet app developed exclusively for iOS devices including iPhone, Apple Watch, iPad, and Mac. It allows users to store credit cards, debit cards, loyalty cards, boarding passes, tickets, gift cards and more in one central place on their Apple device.

Apple Wallet uses Near Field Communication (NFC) technology for contactless payments in stores, with Apple Pay. It is also integrated with other Apple services like Apple Cash and Apple Card.

Overview of PayPal

PayPal is an online payments platform and digital wallet owned by PayPal Holdings, Inc. It allows users to make financial transactions online by storing debit/credit card information or connecting bank accounts.

PayPal can be used for:

- Online purchases

- In-store payments

- Peer-to-peer (P2P) transfers

- Paying and accepting payments as a business

It is available as a mobile app on iOS and Android devices. Users can also access it through desktop/laptop browsers.

Key Differences Between Apple Wallet and PayPal

Compatibility

The most significant difference between Apple Wallet and PayPal is compatibility.

- Apple Wallet only works on Apple devices and is limited to the Apple ecosystem. It requires an iPhone, Apple Watch, iPad or Mac.

- PayPal has apps for both iOS and Android. It can also be accessed from any desktop or laptop browser. So PayPal is compatible across platforms and devices.

Payment Options

Apple Wallet focuses specifically on card payments, loyalty programs, tickets etc. It does not facilitate bank transfers or allow paying with a PayPal balance.

PayPal offers more flexibility for sending, receiving and withdrawing money:

- PayPal balance

- Bank account transfers

- Debit/Credit card payments

- Cryptocurrency support

- PayPal Credit account

- Peer-to-peer transfers between PayPal users

So PayPal accommodates more payment methods beyond just card transactions.

Security

Apple Wallet utilizes biometric authentication with Face ID or Touch ID on Apple devices for secure access. It also generates unique device-specific numbers for payments instead of your actual card details.

PayPal uses 2-factor authentication via text/email codes or an authentication app for account login. But it lacks biometric login which Apple Wallet has.

Both utilize encryption and other security measures to protect user information and prevent fraud. Apple Wallet has an edge with its tight biometric security integration into Apple hardware.

Integration

Apple Wallet is deeply integrated into the Apple ecosystem. It works seamlessly with other Apple services and devices:

- Use Apple Cash balance to make Apple Pay payments

- Store Apple Card digitally in Wallet

- Scan/upload loyalty cards and member cards into Wallet

- Organize tickets for concerts, flights, events in Wallet

- Access and pay with Wallet on iPhone, Apple Watch, iPad and Mac.

Whereas PayPal functions as an independent platform and mobile app. While it offers some integrations with third-party services, it does not have the same seamless connectivity across an ecosystem that Apple Wallet does.

Using Apple Wallet

Here are some of the key features and uses of the Apple Wallet app:

- Apple Pay – Make contactless payments in stores using credit/debit cards added to Wallet. Just hold your iPhone near the payment terminal.

- Loyalty/Membership Cards – Store loyalty cards from retailers, member cards for gyms, theaters etc to access deals, points and skip carrying physical cards.

- Tickets – Have tickets for flights, movies, concerts etc available in Wallet to scan at the venue.

- Passes – Add boarding passes, coupons and gift cards to Apple Wallet.

- Student ID – Students at participating universities can add their IDs to Apple Wallet.

- Keys – Store digital keys for cars and homes to unlock supported vehicles and doors right from Wallet.

- Apple Cash – Transfer money from Apple Cash to bank account or use it to make purchases with Apple Pay.

Apple Wallet provides access to payments, ticketing, identification, keys and loyalty programs in one application on Apple devices.

Using PayPal

Here are some of the main features and uses of PayPal:

- Send and receive money – Easily send money to friends & family or receive funds into your PayPal account using just an email address or mobile number.

- In-store payments – Use PayPal to tap and pay at supported merchants and retailers in store using the PayPal mobile app.

- Online purchases – Check out faster on supported ecommerce sites by selecting PayPal at checkout. No need to enter lengthy card details every time.

- Withdraw funds – Withdraw money from your PayPal balance to your connected bank account or eligible debit card.

- Bill Pay – Pay your bills directly from PayPal to avoid manually logging into biller websites.

- Donate to charities – securely contribute to charitable causes through PayPal’s giving platform.

- Business payments – If selling products/services, integrate PayPal as a payment gateway to accept credit cards, PayPal, Venmo and more.

PayPal acts as both a digital wallet for consumers and a payment platform for businesses and non-profits.

Similarities Between Apple Wallet and PayPal

Despite their differences, Apple Wallet and PayPal also have some similarities:

- Both allow storing debit/credit cards for payments

- Offer easy mobile checkout in apps and webstores

- Let users manage financial accounts and transactions from one place

- Utilize encryption and tokenization for security

- Enable contactless tap-to-pay at supported point-of-sale systems

- Are free to use (though some transactions may have fees)

Which Should You Choose?

| Apple Wallet | PayPal |

| Best if you want seamless integration with other Apple products and services | Best for cross-platform compatibility with Android, iOS, web access |

| Limited to Apple ecosystem – only works on Apple devices | Access PayPal on any mobile device, computer browser or tablet |

| More convenient for in-person transactions using Apple Pay | More options for peer-to-peer transactions, sending/receiving money |

| Focuses on payments, ticketing, identification. Not for peer-to-peer money transfers or withdrawals | Allows bank account withdrawals and deposits, not just payments |

| Simple elegant interface tailored for Apple users | Offers a full-featured wallet accessible across devices and platforms |

| Excellent security with Face/Touch ID biometric login. But only works with Apple devices so limited use | Relies on 2FA and other measures for security. Vulnerable on some platforms lacking biometric login |

| Apple Card integration, rewards and financing options | Supports many payment methods – credit, debit, bank transfer, PayPal balance, Venmo, cryptocurrency |

| Limited third-party compatibility – mostly designed for Apple’s own ecosystem | Third-party app integration with Xoom, Braintree, Hyperwallet along with partnerships like Uber, Facebook, eBay |

In summary:

- Apple Wallet is best if you use multiple Apple devices and want seamless integration with Apple services. It excels at contactless payments using Apple Pay.

- PayPal is ideal if you want flexibility across platforms. It offers more payment methods and money transfer capabilities beyond just card transactions.

For peer-to-peer payments, bank withdrawals or multi-platform access – PayPal is likely the better choice. But Apple Wallet provides better hardware integration, in-store payments and security on Apple devices specifically.

Key Takeaways

- Apple Wallet only works on Apple devices; PayPal works across platforms like iOS, Android, web.

- PayPal supports more payment methods beyond cards – bank transfers, PayPal balance etc.

- Apple Wallet focuses on device integration, payments and passes – PayPal offers full financial account features.

- Apple Wallet has tighter security integration with Apple biometrics.

- PayPal allows direct p2p transfers – Apple Wallet uses Apple Cash.

- For Apple ecosystem, Apple Wallet is best. For flexibility across devices, PayPal is better.

Conclusion

Apple Wallet and PayPal are both convenient digital wallets but intended for different use cases. Apple Wallet enables simple and secure payments, ticketing, identification and access on Apple devices specifically. Whereas PayPal acts as a full financial account for money transfers across platforms. Both have their strengths in specific scenarios. For peer-to-peer transfers, withdrawals and non-Apple device support, PayPal is likely the more versatile option. But Apple Wallet provides the most integrated experience for Apple users.

Frequently Asked Questions

-

Can I use Apple Wallet on Android?

No, Apple Wallet is only available on Apple devices like iPhone, iPad, Mac and Apple Watch. There is no version for Android platforms.

-

Is Apple Wallet better than PayPal?

It depends. Apple Wallet has better device integration and security on Apple hardware but PayPal is more flexible across platforms. For pure payments, Apple Wallet offers a smoother user experience within the Apple ecosystem specifically.

-

Is Apple Wallet completely free to use?

Yes, Apple Wallet is a free app. However, there may be some transaction fees involved when making payments via Apple Pay or using certain services through Wallet.

-

Can I send money to friends with Apple Wallet?

Not directly. But you can use Apple Cash within Wallet to send money to contacts, then they can transfer the Apple Cash balance to their bank account. There are limits on Apple Cash transfers.

-

Is PayPal banned anywhere?

PayPal is fully available in over 200 countries/regions but may have limited functionality in some parts of Africa, Middle East, and Asia. Some countries like Pakistan prohibit PayPal transactions from within the country but allow receiving money.

-

Is PayPal considered a bank?

No, PayPal is not a bank. It is a financial services company that offers online payment systems. PayPal partners with banks and other regulated financial institutions to handle banking-related functions.

-

Can I link PayPal and Apple Pay?

You cannot directly link a PayPal account to Apple Pay. But you can link a debit/credit card connected to your PayPal account and use that with Apple Pay. This lets you use money from a PayPal balance for Apple Pay transactions.

-

Is Apple Wallet the same as Apple Pay?

No. Apple Wallet is the app that stores cards, passes and information. Apple Pay is the contactless payment service that lets you use the cards stored in Apple Wallet to make purchases.

-

Is it safe to use Apple Wallet?

Yes, Apple Wallet is very safe to use for payments and storing cards. It uses encryption, tokenization, Face ID/Touch ID login, and other security measures to protect user information.

-

Can stolen phones use Apple Wallet?

No. If a phone with Apple Wallet is lost or stolen, Find My iPhone can be used to erase the contents remotely, preventing the thief from using Wallet. Biometric login also prevents unauthorized physical access.

-

Does Apple Wallet work offline?

Apple Wallet requires an internet connection to set up cards initially but can then make contactless payments offline in stores where NFC payments are accepted. However, other Wallet features like tickets and passes still require connectivity.

-

Can I use Apple Wallet internationally?

Yes, Apple Wallet works internationally thanks to NFC compatibility. Contactless Apple Pay transactions are available in over 70 countries/regions. Just make sure your bank card also supports international usage.

-

Does PayPal support international payments?

Yes. PayPal lets you send, receive, and withdraw money internationally in over 100 currencies. You can send money abroad to PayPal users in eligible countries.

-

What credit cards support Apple Pay?

All major card networks like Visa, Mastercard, American Express, and Discover work with Apple Pay. Individual card issuers decide if their cards support Apple Pay, so check with your provider.

-

Can I link multiple PayPal accounts to my Apple ID?

No, you cannot link PayPal accounts directly to your Apple ID. But you can add multiple cards/bank accounts linked to different PayPal accounts to Apple Wallet and use them for Apple Pay.

-

Is PayPal better than Apple Pay?

It depends on your needs. Apple Pay provides better encryption and integration with Apple devices. But PayPal offers flexibility across platforms that Apple Pay lacks.

-

Can I use PayPal Credit with Apple Pay?

Yes, you can add a PayPal Credit account to Apple Wallet and use it to make Apple Pay purchases anywhere Apple Pay is accepted. The transactions show up as standard PayPal Credit purchases.

-

Is Apple Wallet free to use internationally?

Yes, there are no fees to use Apple Wallet itself internationally. However, standard international transaction fees from your bank/card issuer may still apply.

-

Can I use Apple Cash internationally?

At this time Apple Cash can only be used domestically in the United States. International expansion is expected in the future.

-

Can I send money to another country with PayPal?

Yes, PayPal allows you to easily send money to recipients in over 200 countries and regions internationally. Just make sure your account is verified for international money transfers.