Apple Pay may ask for your SSN to verify your identity and prevent fraud when setting up Apple Card. Providing SSN helps build credit history but isn’t required. Safeguards protect your data.

Why is Apple Pay asking for my Social Security Number?

Apple Pay may ask you to provide the last 4 digits of your Social Security number (SSN) when setting up Apple Card or Apple Cash to verify your identity and prevent fraud. Here are some key reasons why Apple Pay requests SSN:

To Verify Your Identity

Providing part of your SSN helps Apple verify your identity and ensure you are who you say you are. It prevents fraudsters from trying to set up an account in your name without proper ID. SSN is a standardized way for Apple to confirm you are a real person.

To Check Your Credit History

Your SSN allows Apple Pay to check your credit history and FICO score when applying for Apple Card. This helps determine your creditworthiness and set your credit limit and interest rate accordingly. Your SSN enables a credit check as part of the application process.

To Build Your Credit Profile

Supplying the last 4 digits of your SSN enables Apple Pay to start building up your credit profile and history. It ties the Apple Card account to your existing profile so all your credit activity feeds into one report. This establishes your reputation as a borrower.

To Follow Legal Requirements

Apple Pay asks for part of your SSN to comply with anti-money laundering laws and Know Your Customer regulations. These require financial institutions to verify a customer’s identity. Providing SSN helps Apple meet legal and compliance standards.

For Account Recovery

Having your SSN on file allows Apple to verify your identity if you ever need to recover your lost or compromised Apple Pay account. Your SSN provides authentication in case you lose access to the account.

So in summary, Apple primarily requests the last 4 digits of SSN at signup to confirm you are a legitimate applicant, check your creditworthiness, build your credit history, satisfy legal requirements, and assist in account recovery. It is a standardized way to verify applicants.

Is it safe to give Apple Pay your SSN?

Many consumers reasonably worry about the privacy and security risks of providing their Social Security number. However, only providing the last 4 digits to Apple Pay is generally considered safe due to the following protections in place:

Data Encryption

Any SSN data provided to Apple Pay is encrypted and securely stored using industry-standard techniques. This prevents hackers from accessing the data in plain text.

Limited Data Collected

Apple Pay only collects the last 4 digits of your SSN, rather than the full 9 digits. This limits exposure and makes identity theft more difficult.

Trusted Company

Apple is a large reputable company with robust cybersecurity practices. They have proven able to responsibly handle user data on a large scale over many years.

Legal Protections

There are laws prohibiting misuse of SSN and penalties for companies that mishandle consumer data. This provides legal accountability for Apple.

Internal Access Restrictions

Only a small subset of Apple employees with authorization have access to SSN data due to internal access controls. Your SSN is not openly shared within the company.

So because they collect limited data, handle it securely, and restrict internal access, it is reasonably safe for consumers to provide the last 4 SSN digits to Apple Pay. However, consumers should always remain vigilant about phishing risks and monitor their credit reports regardless.

Can I use Apple Pay without providing SSN?

You can use certain Apple Pay services without having to provide any SSN information:

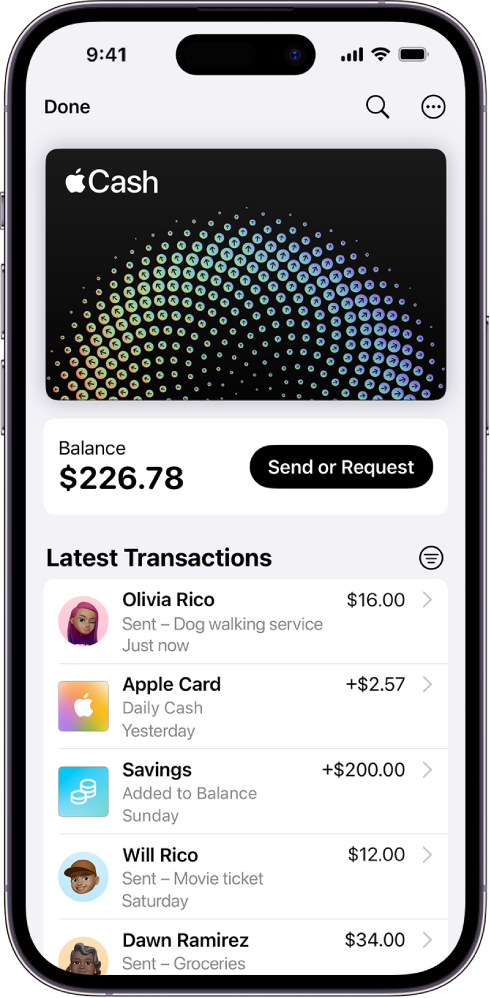

- Apple Cash – You can send and receive money via Apple Cash without entering any SSN data during setup. SSN is optional for Apple Cash.

- Retail Purchases – You can use your Apple device for Apple Pay purchases at retail stores without providing your SSN. No SSN is needed for these types of transactions.

- iCloud – You can pay for iCloud storage subscription without submitting an SSN. Your SSN is not required for iCloud.

However, your SSN is required when:

- Applying for Apple Card – SSN is mandatory to apply for Apple Credit Card so Apple can run a credit check.

- Activating Apple Card Monthly Installments – Apple needs your SSN to approve installments and report payment history.

So in summary, while you can use certain Apple Pay services without SSN, applying for Apple Card itself requires providing part of your SSN to meet credit reporting legal requirements. The last 4 digits are mandatory for approval.

What does Apple do with my SSN data?

Apple primarily uses your supplied SSN data for identity verification, credit checks, credit reporting, and legal compliance:

- Identity Verification – Apple verifies the SSN matches your identity to combat fraud during account setup.

- Credit Checks – Apple sends SSN to credit bureaus like TransUnion to check your credit report and score.

- Credit Reporting – Apple reports your monthly Apple Card payments to credit bureaus via your SSN to build your credit history.

- Legal Compliance – Regulators require collecting SSN to comply with anti-money laundering and customer identification laws.

- Account Recovery – Apple uses your SSN to verify identity if you ever lose access to your Apple Pay account.

Apple generally does not use your SSN for marketing purposes or share the data with third parties not involved in credit reporting and verification. Your SSN is primarily for confirmation, credit checks, reporting, compliance, and account recovery only.

Can I use a fake SSN on Apple Pay?

You should never enter a fake or false SSN when setting up Apple Pay accounts like Apple Card. Here’s why:

- Verification Failure – A fake SSN will fail identity verification checks and lead to declined applications.

- Credit Check Issues – A false SSN produces errors on credit history checks needed for Apple Card approval.

- Legal Risks – Providing false personal information like SSN could be considered an attempt at fraud.

- No Credit History – Fake SSN results in no valid credit profile being built as payments are not properly reported.

- Account Lockout – Apple will likely permanently lock accounts with intentionally false SSN data provided at signup.

So attempting to enter a fake or made up SSN could lead to approval failure, credit reporting problems, potential legal issues, inability to build legitimate credit, and even permanent account suspension. It is never advisable to provide false SSN information to Apple Pay or any financial provider.

Can I use someone else’s SSN on Apple Pay?

Submitting someone else’s Social Security Number during Apple Pay signup can have serious negative consequences:

- Identity Theft – Using another person’s SSN constitutes identity theft and is illegal. It can result in criminal prosecution.

- Application Denial – SSN mismatches will cause application verification failure and immediate denial.

- Erroneous Credit Report – All payment history will be incorrectly tied to the wrong SSN on credit reports.

- Account Suspension – Apple will likely permanently suspend your account for SSN identity mismatches.

- Damaged Credit – The victim could have their credit erroneously damaged by payments linked to their SSN.

There is no valid reason to enter someone else’s SSN on any Apple Pay application. Doing so is considered identity theft, will certainly result in denial, and opens you up to potential criminal charges and lawsuits. Never enter a SSN that isn’t directly associated with your identity.

What if I’m asked for SSN but don’t have one?

If Apple Pay requests a Social Security Number during signup but you do not have an SSN, you can contact Apple support for alternatives:

- Non-U.S. Citizens – Foreign nationals without an SSN can instead provide a passport number plus alternate ID to verify identity.

- Temporary Visa Holders – Those in the U.S. temporarily can offer a valid visa number to confirm identity if no SSN.

- Religious Exemptions – Certain religious groups exempted from SSN can offer alternate confirmation like IRS ID number.

- Minor Children – Apple provides parent/guardian co-signing for kids under 18 without SSN to use Apple Cash.

So even without an SSN, Apple Pay provides alternative options to verify identity, perform credit checks as permitted by law, properly report credit history, and comply with regulations. Reach out to Apple support for guidance on acceptable substitute ID numbers if needed.

Can I remove my SSN from Apple Pay after activation?

Unfortunately, you cannot remove or delete a Social Security Number provided during Apple Pay and Apple Card activation after the fact. Here’s why:

- Identity Verification – SSN is required for the initial identity confirmation and cannot be removed after approval.

- Credit History – Your SSN links the account to your existing credit profile and cannot be changed later.

- Regulatory Compliance – SSN must remain on file to satisfy data retention regulations.

- Ongoing Payments – Your SSN enables proper recording of payment history to credit bureaus.

- Account Management – Apple uses SSN internally for continuing account maintenance needs.

So due to identity confirmation, credit reporting, compliance, and account management requirements, Apple does not allow removal of your SSN from their internal systems once submitted and verified during Apple Pay account creation. It must remain associated with your account.

However, you can contact Apple to deactivate your Apple Pay services like Apple Card if you no longer wish to use the platform. But your SSN itself cannot be deleted after providing it to Apple.

Can I use a prepaid card for Apple Pay?

You can use certain prepaid debit cards with Apple Pay, but prepaid credit cards may not work:

- Prepaid Debit Cards – Major debit card issuers like Visa, Mastercard, and American Express enable using their prepaid debit cards with Apple Pay.

- Prepaid Credit Cards – Prepaid credit cards are often not accepted, as Apple Pay requires a SSN for credit approvals.

- Gift Cards – Store and merchant gift cards can be added to Apple Wallet for Apple Pay purchases if they have Visa/MC/AMEX logos.

- Cash Cards – Prepaid cash cards from GreenDot, Netspend, etc. function like debit cards and work with Apple Pay.

So most prepaid debit cards and cash cards supported by the major card networks can be added to Apple Pay. But prepaid credit cards that do not require SSN verification are often declined. Check with your prepaid card provider for Apple Pay compatibility.

Can I use Apple Pay before my physical card arrives?

Yes, you can begin using your Apple Card with Apple Pay as soon as it is digitally approved, even before your physical titanium card arrives in the mail. Here’s how:

- Digital Card Provisioning – Your Apple Card is uploaded to Apple Wallet and ready for Apple Pay as soon as approved.

- Immediate Usage – You can tap and pay immediately with your new digital Apple Card via Apple Pay before the physical card is delivered.

- Virtual Account Number – Your card number, CVV, and expiration date are available in the Wallet app if you need them.

- No Transaction Limits – There are no usage limits or restrictions on the digital card while waiting for the physical one.

So Apple enables using the fully functional digital version of your Apple Card via Apple Pay right away when approved, with no waiting required for the physical card arrival to start making payments.

Can you get 2 Apple Cards?

Normally you can only have one Apple Card per individual, but there are a couple special scenarios where you may be able to obtain a second Apple Card:

- Joint Applications – Married couples can apply for a joint Apple Card account with a shared credit limit in addition to their individual ones.

- Business Usage – Self-employed individuals can apply separately for a personal Apple Card and an Apple Card for business spending.

- Separate Devices – If you have an iPhone and iPad you may be able to add Apple Card to both, appearing as two cards but still one account.

However, for a single person using Apple Card for personal consumer use, Apple will not approve two separate Apple Card accounts with independent credit limits. Generally only one personal Apple Card is allowed per individual.

So having two Apple Cards is extremely rare except for spouses with a joint account or small business owners with separate business accounts. Two personals cards are not approved.

What credit score is needed for Apple Card?

You generally need a minimum credit score of around 650 to be approved for Apple Card. Here are more details on required credit scores:

- Excellent credit (750+) – Best approval odds and highest credit limit offers.

- Good credit (700-749) – Very good chance of approval and good credit limits.

- Fair credit (650-699) – Base minimum score needed but lower limits.

- Poor credit (<650) – Almost no chance of approval with a low score.

So while it’s possible to get approved with a fair 650 score, 750+ gives you the best approval odds and credit line. Anything under 650 is usually denied. Having an established credit history is also important – Apple Card is difficult to obtain as a first-ever credit account.

The exact minimum score needed can vary based on your other credit report factors like history length, types of credit, payment history, balances, and inquiries. But in most cases, 650 FICO is the baseline for Apple Card approval.

How can I use Apple Card without iPhone?

Since Apple Card is designed for iPhone, using it without an iPhone is limited but possible in a few ways:

- Physical Titanium Card – You can request a physical Apple Card to use in stores and ATMs without an iPhone present.

- iPad Support – Add Apple Card to Apple Wallet on your iPad to access it for purchases without an iPhone.

- Account Information – You can view your account number and virtual card details to make purchases online without iPhone.

- Customer Support – Contact Apple Card support via the website or phone for assistance without iPhone access.

But key functions like rewards tracking, spending summaries, payment management, and Apple Pay integration require an iPhone with Apple Wallet. So using Apple Card fully without any iPhone access is not really feasible over the long-term. The physical titanium card provides basic offline access.

Can Apple Card be hacked? How safe is it?

Apple Card utilizes extensive security protections to keep your data and transactions safe:

- End-to-end encryption secures all payment data.

- Device Account Numbers replace vulnerable card numbers.

- No CVV or signature makes card skimming impossible.

- Biometric authentication via Touch ID/Face ID verifies purchases.

- Physical titanium card has no numbers, preventing theft.

- Virtual card numbers enhance privacy for online transactions.

So thanks to Apple’s advanced security built into Apple Card, the risk of hacking and fraud is extremely low compared to traditional credit cards. Apple Pay provides best-in-class payment security.

However, users should still monitor statements closely and contact Apple about unauthorized charges for fraud protection. No payment system is completely bulletproof. But Apple Card’s innovative security makes it very safe.

<div class=”key-takeaways”>

Key Takeaways

- Apple Pay asks for SSN to verify identity, check credit history, build credit profile, follow regulations, and enable account recovery.

- Providing just last 4 SSN digits to Apple is generally safe due to data encryption, limited data access, trusted reputation, legal protections, and access restrictions.

- SSN is required for Apple Card approval but optional for some services like Apple Cash and retail Apple Pay.

- SSN enables identity confirmation, credit checks, proper credit reporting, and legal compliance. It is not used for marketing.

- Fake or another person’s SSN will lead to application denial, erroneous credit reports, potential fraud charges, and account suspension.

</div>

Conclusion

In summary, Apple Pay requests the last four Social Security Number digits during account creation for key reasons like identity verification, credit checks, building your credit history, complying with regulations, and account recovery if needed. Given Apple’s security safeguards, it is reasonably safe to provide as long as users take precautions around data sharing and regularly review their credit reports. While inconvenient, Apple’s SSN requirement ultimately protects consumers and allows them to establish a credit profile linked to a trusted financial services account.

Frequently Asked Questions

Here are 20 additional FAQs about Apple Pay and SSN:

-

Why does Apple Pay need the last 4 SSN digits if they already have my full name and birthdate?

The last 4 SSN digits provide unique personal identification that name and birthdate alone cannot. They allow definitive identity verification and tie payments to your credit profile. -

What law requires SSN for Apple Pay?

Collecting SSN is primarily required under anti-money laundering laws and banking privacy regulations that mandate identity verification and record keeping. -

Does giving SSN to Apple Pay sign me up for anything else?

No, Apple only uses your SSN internally for Apple Pay account purposes and does not share or sign you up for any unrelated products or services. -

Can I use a family member’s SSN if I don’t have one?

No, you must use your own SSN assigned specifically to you. Using a relative’s constitutes identity theft. -

Will my SSN show up when I pay with Apple Pay in stores?

No, your SSN is never transmitted when using Apple Pay and is only collected by Apple internally during account setup for identification purposes. -

How long will Apple keep my SSN on file?

Apple will likely keep your SSN on file indefinitely due to credit history reporting, account management, and regulatory requirements. It is not deleted. -

Is providing SSN to Apple Pay riskier than giving it to my bank or credit card company?

No, Apple is subject to the same banking privacy laws and protects.