Mobile payment services like Apple Pay and PayPal have become increasingly popular in recent years. More and more people are using their smartphones or smartwatches to make quick and convenient payments in stores, restaurants, and online retailers.

But with any electronic payment service, security is a top concern. Users want assurance that their financial information and transactions are safe from hacking and fraud. So how do Apple Pay and PayPal compare when it comes to safety and security?

This article will examine the technology and security features behind each service, looking at factors like encryption, anonymity, fraud protection, and more. The goal is to help you better understand the relative security of Apple Pay versus PayPal, so you can choose the right option for your needs and comfort level.

How Apple Pay Works

Apple Pay allows users to load their credit and debit card information onto their iPhone or Apple Watch. They can then make payments in stores simply by holding their device near a compatible point-of-sale terminal.

Apple Pay is also accepted on certain apps and websites. Users confirm payments on their Apple device using Touch ID fingerprint authentication or Face ID facial recognition.

Behind the scenes, Apple Pay utilizes Near Field Communication (NFC) technology to wirelessly communicate payment information to the merchant’s payment terminal. This is the same technology used by contactless “tap to pay” credit cards.

When you make an Apple Pay purchase, your actual credit or debit card number is never shared with the merchant. Instead, a unique Device Account Number is assigned and encrypted securely on your device. This means your real card details stay private.

During each transaction, Apple Pay uses a one-time dynamic security code so your card details cannot be reused for fraudulent charges. Apple also keeps all payment transactions separated on your device and assigns them anonymous identifiers.

How PayPal Works

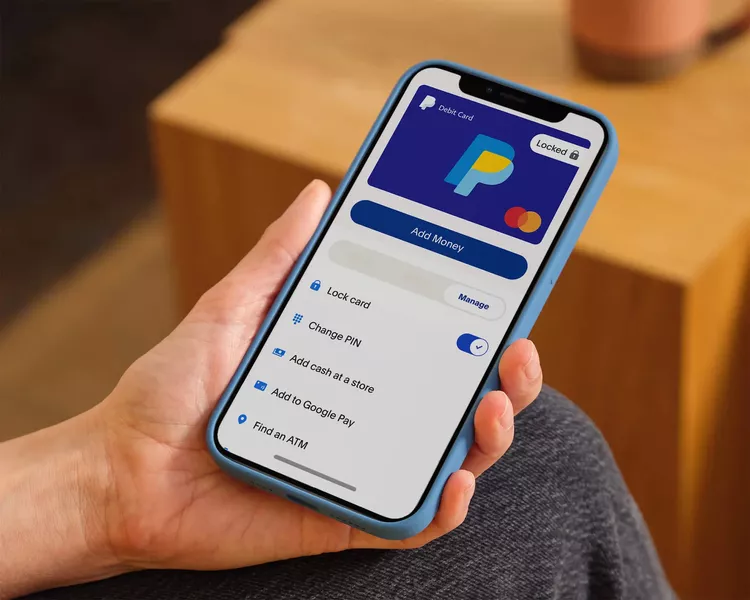

PayPal allows users to securely buy and pay online using their PayPal account balance, bank account, or credit/debit cards linked to their account. Users can send and receive money between PayPal accounts for personal transactions.

To make purchases, users simply log into their PayPal account on the retailer’s website and confirm their identity. PayPal securely communicates with the seller and facilitates the payment transfer from the buyer’s funding source.

PayPal keeps users’ financial information encrypted on secure servers. When making a purchase, PayPal shares transaction details with the seller but does not reveal customers’ sensitive financial data.

PayPal offers various layers of protection against fraudulent charges and unauthorized access. This includes 24/7 fraud monitoring, encryption technology, automated account alerts, and purchase protection guarantees. Users must also log in using an email and password to access their account.

Security Comparison: Apple Pay vs. PayPal

Now let’s analyze some key security differences between Apple Pay and PayPal:

- Device & Biometric Authentication – Apple Pay uses Touch ID or Face ID built into Apple devices to verify a user’s identity for each transaction. PayPal relies on traditional passwords and email authorization.

- Tokenization – Apple Pay uses one-time dynamic security codes tied to a device-specific account number. PayPal uses conventional credit card numbers or bank account details.

- NFC vs Network Communications – Apple Pay only transmits encrypted payment data between the device and terminal over a secure wireless NFC channel. PayPal sends data over networks and the internet.

- Fraud Protection – Both offer comprehensive protection against fraudulent charges and unauthorized access. However, Apple Pay offers the added security of biometric user authentication.

- Anonymity – Apple Pay does not share your name, card number or billing details with merchants. PayPal provides some identity protection but does share your info with sellers.

- Platform Support – Apple Pay is only available on Apple devices. PayPal has wider platform support across various mobile/desktop devices.

- Ease of Use – Apple Pay requires less steps to initiate transactions. PayPal requires logging into accounts and verifying credentials.

Based on these points, Apple Pay has a slight technical edge over PayPal when it comes to security and anonymity. However, for many users, PayPal still provides adequate security and may be more convenient based on wider platform access and ease of account setup.

Which is Safer Overall?

So is Apple Pay definitively “safer” than PayPal? The short answer is: from a pure encryption and anonymity perspective, Apple Pay has a somewhat more secure infrastructure. But both services utilize sophisticated security measures appropriate for their functionality.

For most users, PayPal is still considered safe for online payments across different devices. However, Apple Pay adds an extra dimension of on-device biometric user verification, as well as tokenization that keeps your actual card details obfuscated from merchants. This makes it very difficult for user payment details to be intercepted or used fraudulently.

Here are a few key takeaways when comparing the two services:

- Apple Pay offers the highest level of security for in-person contactless payments using biometric user authentication. PayPal depends more on traditional passwords.

- Both utilize encryption and fraud monitoring to protect user data and prevent unauthorized transactions.

- Apple Pay provides greater anonymity by not sharing user details with merchants during transactions.

- PayPal may be more convenient and accessible across different mobile/desktop devices and web browsers.

- Users must weigh security vs convenience factors and device compatibility for their needs.

Neither system is completely bulletproof from hacking. But both Apple Pay and PayPal employ sophisticated security layers to protect user payment information and transactions from theft and fraud. For most everyday users, both can safely facilitate mobile and online payments as long as basic security best practices are followed.

Tips for Safely Using Mobile Payments

Whichever mobile payment platform you use, here are some tips for getting the most security:

- Only download apps from trusted sources like official app stores.

- Don’t jailbreak devices as this disables built-in security features.

- Protect devices with passcodes, biometric authentication, and remote wipe ability in case of loss or theft.

- Verify merchant and buyer identities for unfamiliar payments.

- Monitor accounts frequently for suspicious charges and set up fraud alerts.

- Use strong, unique passwords and update them regularly.

- Do not use public WiFi for sensitive mobile payments.

- Keep software, apps, and devices updated with the latest security patches.

Conclusion

Apple Pay and PayPal both enable convenient mobile payments online, in apps, and in stores. They each utilize sophisticated encryption, fraud protection, and authentication features tailored to their functionality.

For in-person contactless payments, Apple Pay offers the most secure option by anonymizing user data and requiring biometric device authentication. But for online web payments across different platforms, PayPal provides adequate security for most users’ needs.

By understanding the technology and security measures behind Apple Pay and PayPal, you can determine which is the right fit based on your specific requirements around privacy, convenience, and device ecosystem. Taking basic precautions also helps keep your information and transactions secure.

Whichever mobile payment platform you choose, exercising caution around digital security allows you to take advantage of the speed and simplicity of paying with your smartphone, watch, or fingertip.

Frequently Asked Questions

Is Apple Pay more secure than a credit card?

Yes, Apple Pay is more secure than a physical credit card in several ways:

- It uses device authentication via Touch ID or Face ID to verify it’s you.

- It utilizes one-time transaction codes instead of your actual card number.

- It keeps your card details encrypted on your device only.

Is Apple Pay safer than a debit card?

Similar to credit cards, Apple Pay is safer than using a physical debit card since it adds biometric authentication and doesn’t expose your full card data during transactions.

What if my Apple device is stolen? Can it be used for Apple Pay fraud?

If your iPhone or Apple Watch is lost or stolen, you can use Find My on iCloud.com to remotely lock the device and suspend or remove the ability to use Apple Pay. This renders the device useless for fraudulent contactless payments.

Does Apple Pay require an internet connection to make payments?

No, Apple Pay does not require an internet connection. It uses NFC technology to establish a direct wireless communication channel between the device and payment terminal.

Can merchants see my identity when I pay with Apple Pay?

No, Apple Pay does not reveal your name, payment card number, billing address or any personal information to merchants during transactions. It uses encrypted tokens to anonymize your data.

Does PayPal share my credit card number with sellers?

No, PayPal keeps your financial information encrypted and does not reveal credit card numbers or bank account details to sellers. PayPal shares only necessary shipping/transaction data needed to facilitate the payment.

Is it safe to connect my bank account to PayPal?

Yes, PayPal uses sophisticated security measures like encryption protocols to keep your bank account information secure when linked to your PayPal account. As long as you use a strong password, connecting your bank account to PayPal is generally safe.

Can someone hack my PayPal account with just my email address?

No, your email address alone is not enough to hack into your PayPal account. A hacker would need to know your password as well in order to gain unauthorized access. Always use a unique, strong password to help prevent your account from being compromised.

If my PayPal account is hacked, will I get my money back?

Yes, PayPal provides strong purchase protection in case unauthorized charges are made on your account. If you report unauthorized activity promptly, PayPal will fully reimburse any stolen or fraudulent funds so that you do not lose money.

Is it safe to use PayPal on a public WiFi network?

It’s generally not recommended to use PayPal over a public WiFi network. Public hotspots are more susceptible to data interception and hacking. For optimal security, only use PayPal on a secured private internet connection that you trust.

Can the Touch ID on my iPhone be hacked?

It’s highly unlikely. Apple’s Touch ID technology uses advanced encryption and sensor reads tocreate a secure biometric authentication tool that is very difficult for third parties to crack or replicate.

Which is easier to set up – Apple Pay or PayPal?

Apple Pay is generally quicker and easier to set up, especially for iPhone users. You simply add eligible cards to your Apple Wallet once and then authenticate with Touch ID/Face ID. PayPal requires creating an account with passwords, confirmation codes, etc before use.

Key Takeaways

- Apple Pay and PayPal both utilize sophisticated encryption and security protocols to protect user data and prevent fraud.

- Apple Pay adds an extra layer of biometric user authentication via Touch ID or Face ID when making contactless in-store payments.

- PayPal enables online payments across more platforms, browsers and devices compared to Apple Pay.

- Apple Pay provides more user anonymity by not sharing personal/card details with merchants during transactions.

- Users should assess their specific needs around privacy, convenience and device ecosystem when choosing between the two.

- Basic security practices like strong passwords and fraud monitoring are important for safely using any mobile payment system.

Conclusion

To conclude, both Apple Pay and PayPal employ advanced security measures like encryption, fraud monitoring, and purchase protection to safeguard user information and prevent unauthorized transactions. Apple Pay offers added security for in-person contactless payments via user biometric authentication and tokenization to anonymize card details. PayPal enables online payments across more diverse platforms and browsers. Ultimately, consumers should weigh factors like privacy, convenience, and device compatibility when deciding between Apple Pay vs Paypal based on their specific needs and preferences. Following basic mobile payment security best practices is important regardless of which service you choose.